How It Works

FAST AND EASY CONSULTATION

Talk with our trained and professional advisors to help with your financial needs

what makes ec advisory better?

The Problem

Many individuals and small to medium-sized enterprises (SMEs) struggle with navigating the complexities of financial decisions and securing favorable loan terms. This often leads to poor financial outcomes, limited access to credit, and inadequate strategies for improving credit scores. As a result, these entities miss out on growth opportunities and the financial resources necessary for success. Our challenge is to provide tailored consultancy services that empower clients to make informed financial choices and improve their credit standing.

The Solution

-

No Hidden Fees

-

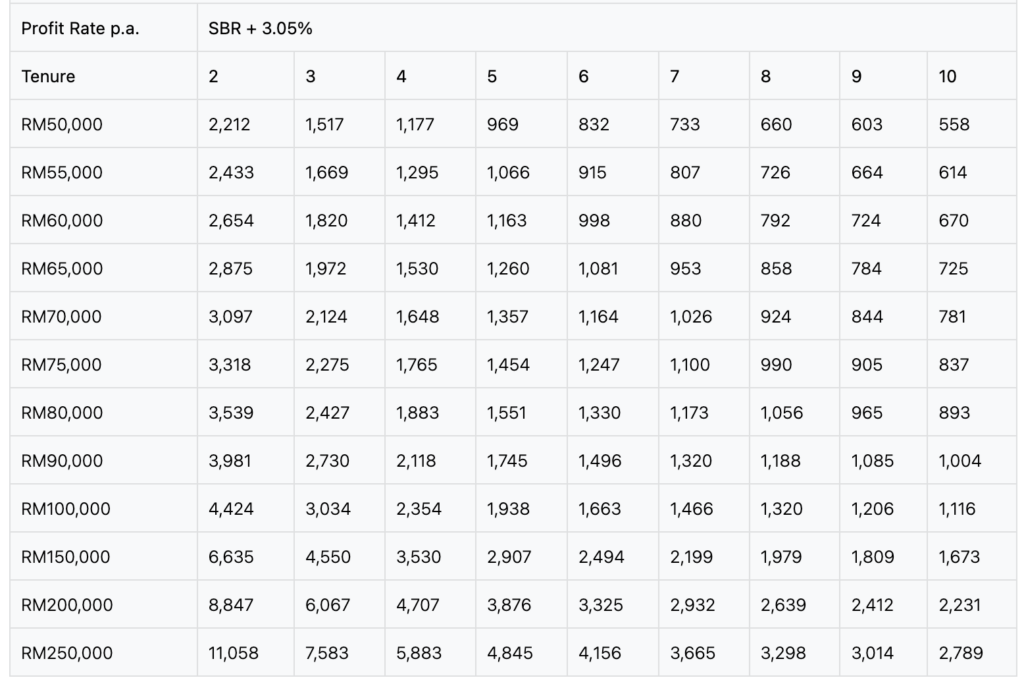

Personalized Rates

-

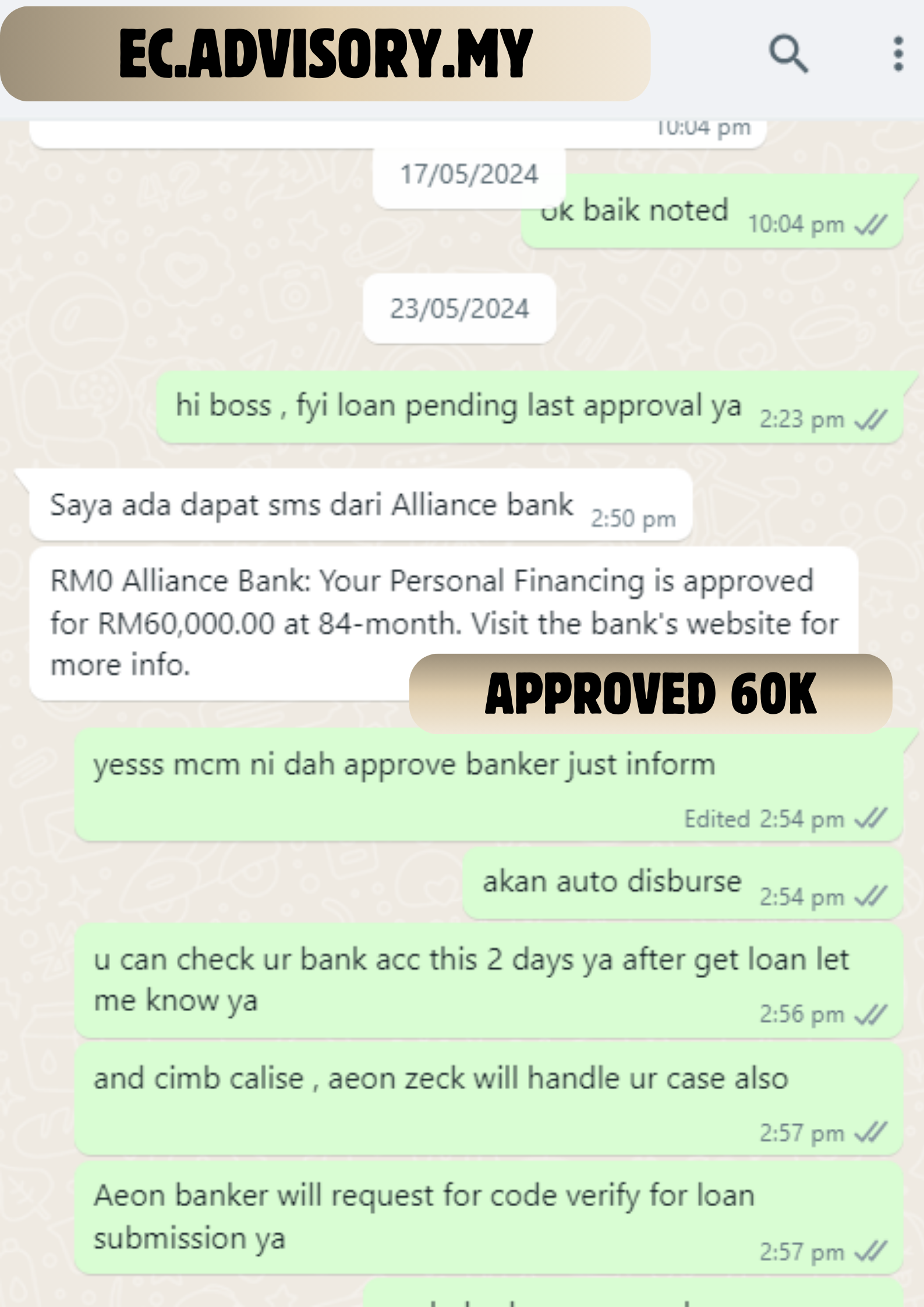

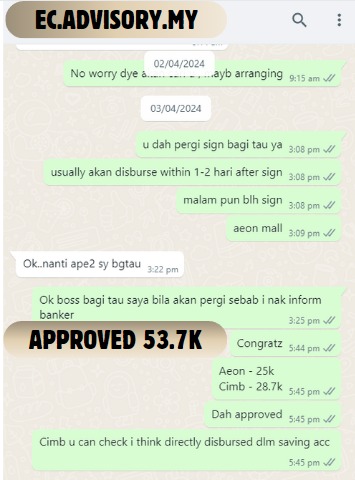

Approval Confidence

-

100% Transparent

What is the reason your application was rejected when you applied for a personal loan from a bank?

-

Late bank payment

-

High commitment

-

Low Credit score

-

Bad documents

-

and etc....

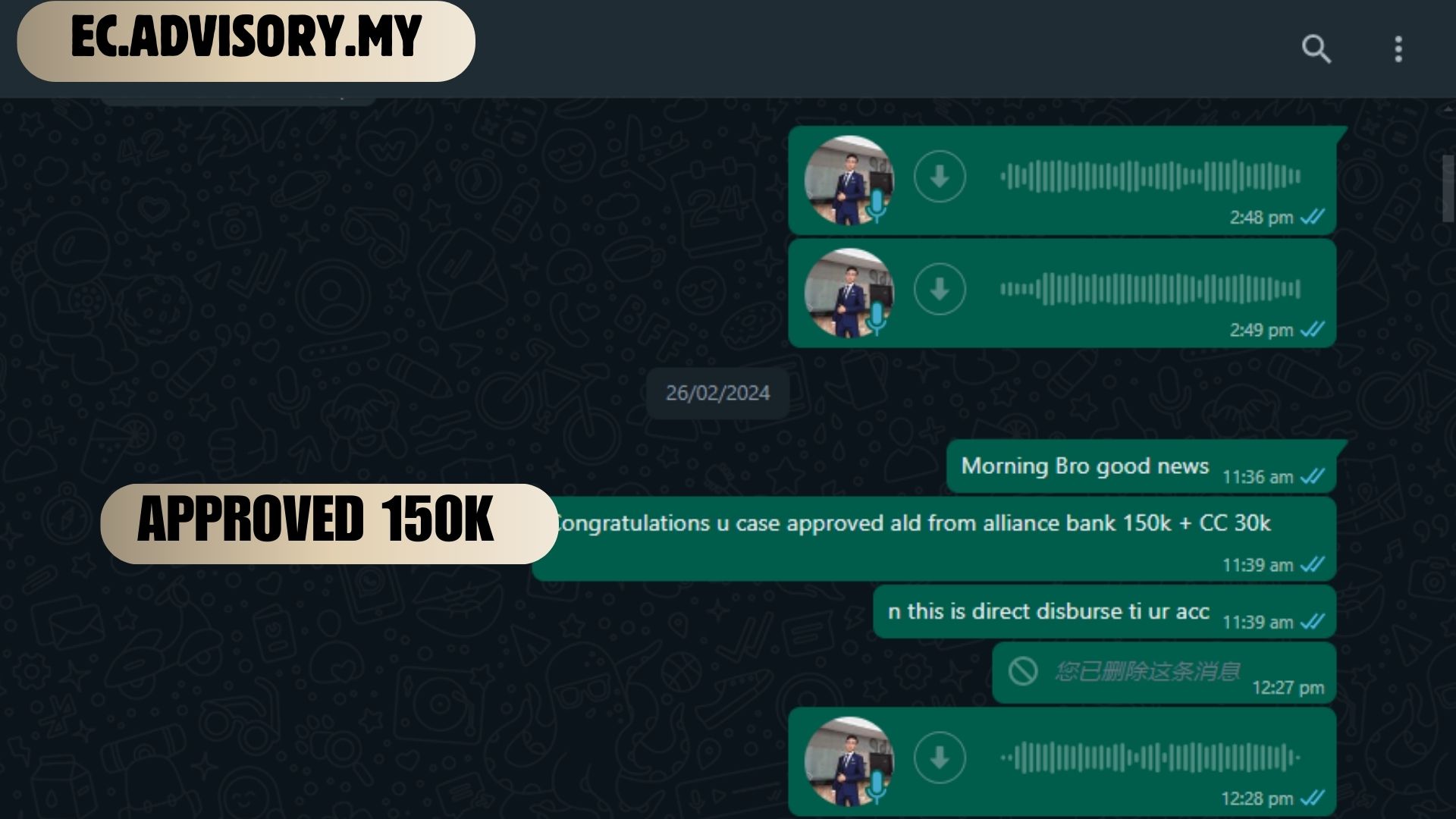

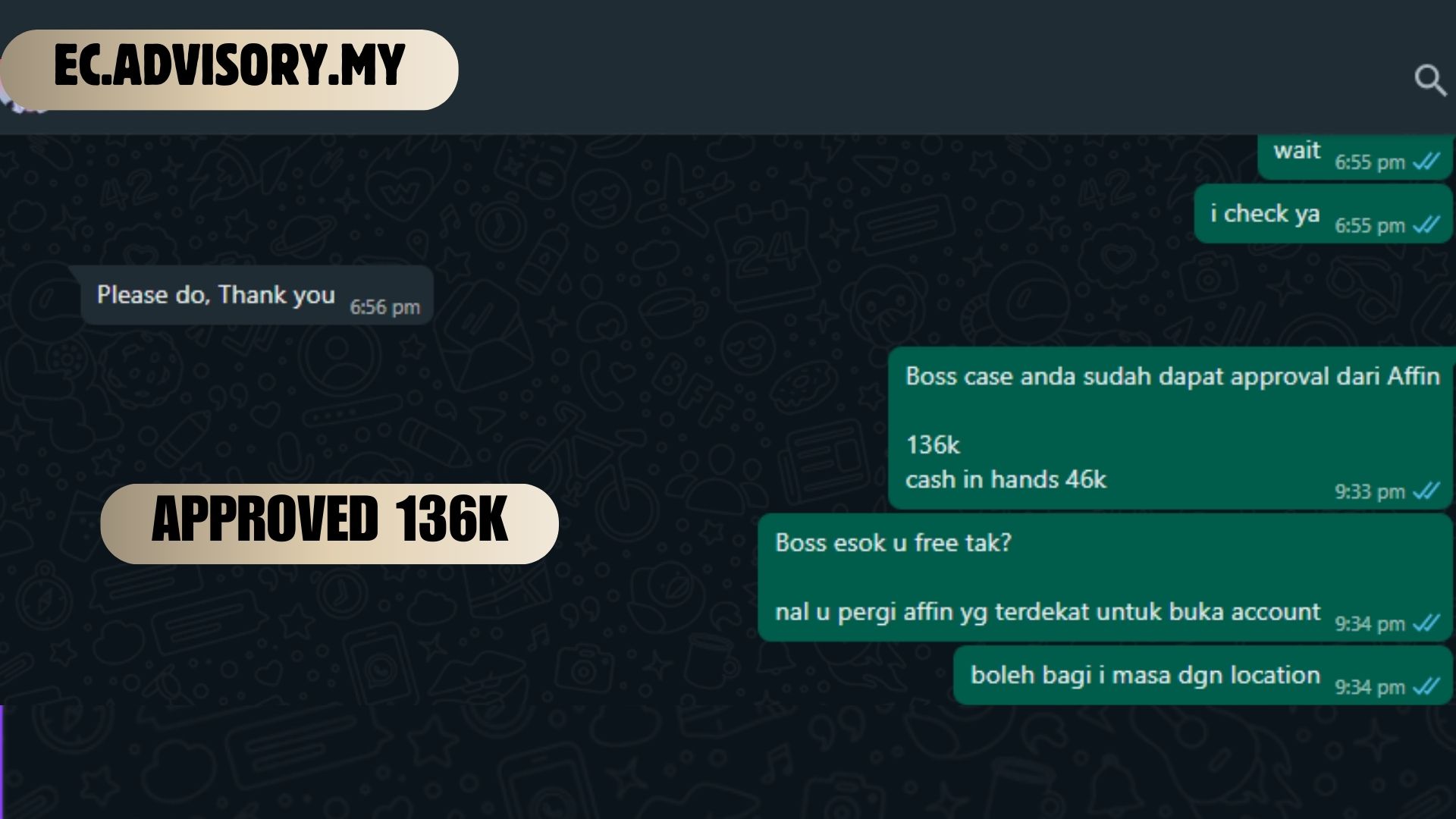

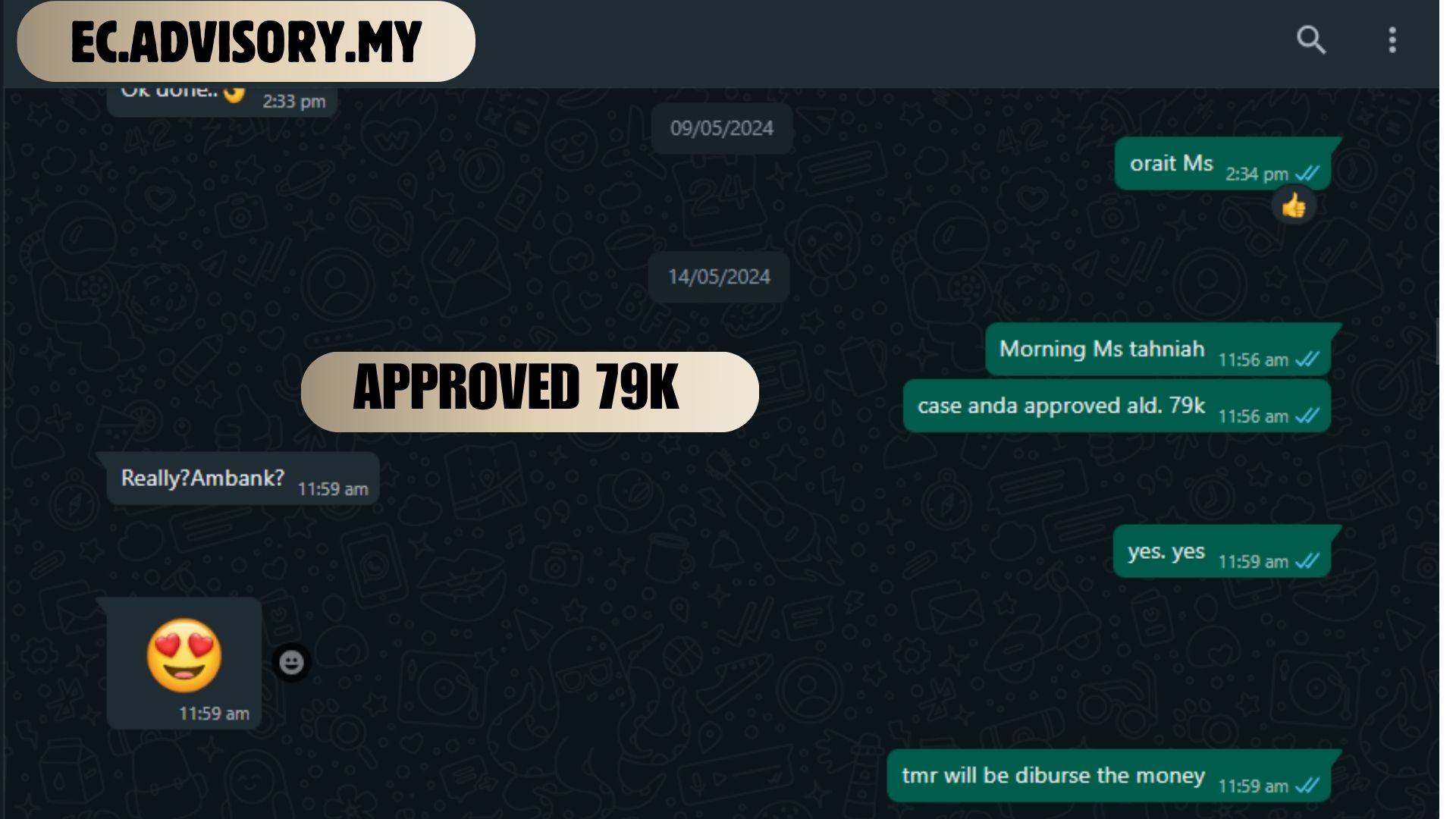

We will help you in applying your personal loan with the bank

With high rate in it getting accepted and approved.

Reduce commitments, settle credit cards and high interest debts.

All cards and loans, combine into one loan.

Set bad payment history/blacklist and then apply.

Get loans with the lowest interest, as low as 2.xx%

Get high amount loans up to million

the best bank intrest rate , from 2.xx%/yearly

we have help millions of our customers

EC ADVISORY

How It Works

How ec advisory works

We will guide you through every step, ensuring all documentation is correct, increasing the chances of approval

Discover how personal loans can benefit you. As a personal loan consultants, we offer a hassle-free, tailored experience. Navigate your financial needs with us and turn dreams into reality through our easy and swift application.

Our business loan consultants offer guidance to expose you with flexible SME business loan options to meet your unique needs, whether you are scaling or starting an SME. Let’s transform challenges into your success story together.

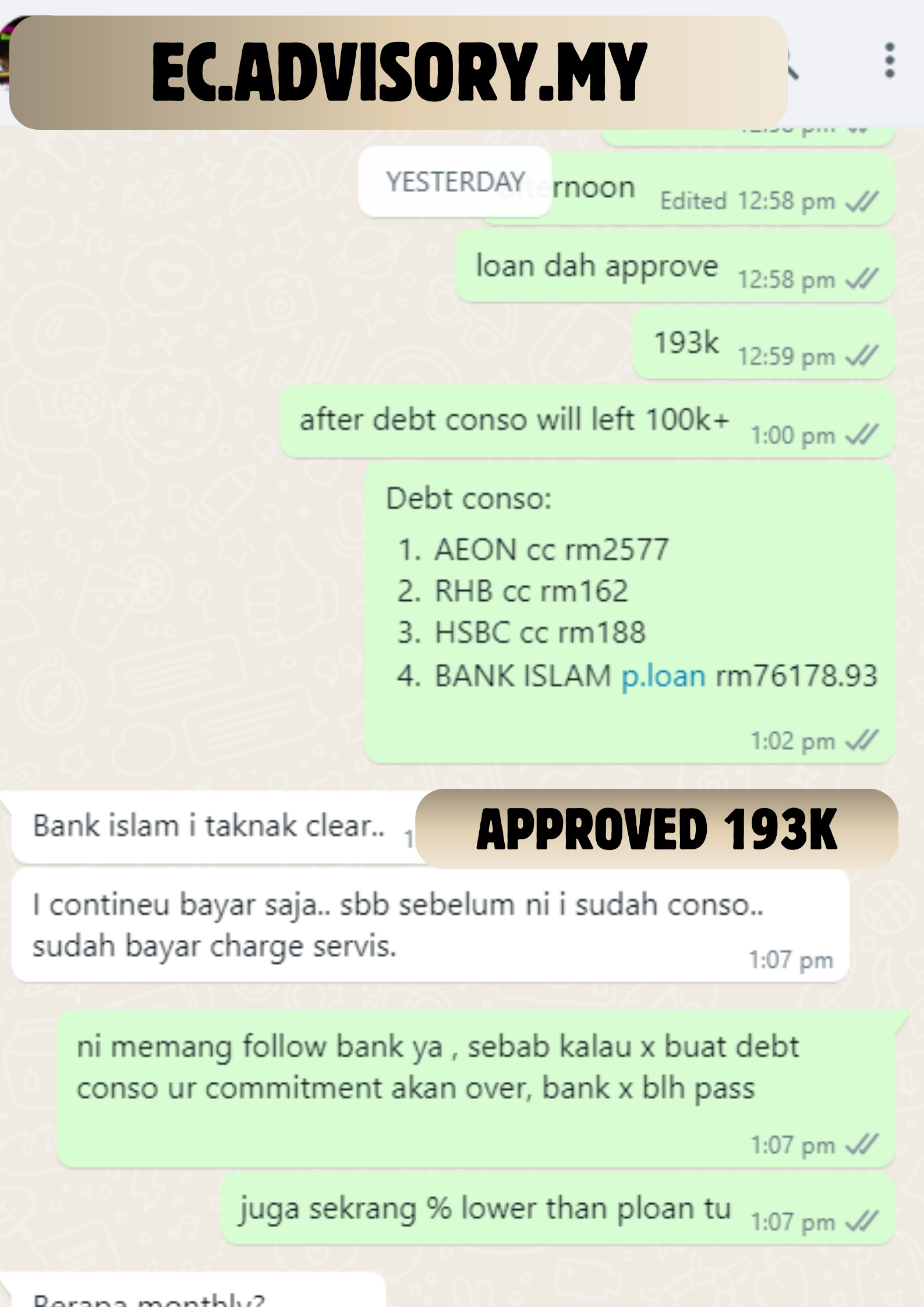

Overwhelmed by multiple debts? Discover low interest debt consolidation loans with with our professional debt consolidation advisors. Streamline payments, save money and steer towards a stress-free financial future. .

With advice from our professional mortgage loan consultants, we simplify home financing and help you to find the perfect mortgage loan. Whether it is buying a new home or refinancing, let’s unlock your dream together.

Our top services

Compare mutliple services to meet your needs

Type of services

Description

Credit Report Consultancy

credit report checking and consulting services to keep you informed. With our assistance you can easily check your credit score online and receive expert advice on how to understand and improve.

Bank Loan Consultancy

providing top-quality loan consultation services that will help you comprehend the complex requirements of bank loans. We empower you with the confidence to make financial decisions

Debt Consolidation

we can help you with debt consolidation even if your credit is bad or imperfect. We’ll simplify your debts into one manageable payment with a lower interest rate.

WHY USE OUR SERVICES?

We operate with integrity, providing transparent advice without any hidden motives or undisclosed affiliations.

We possess deep insights into loan processes, requirements and terms that many might overlook

We stay updated on the latest policies, ensuring that you fully understand and can make informed choices.

We advise on strategies to improve credit scores, manage debt and optimise financial health.

We identify potential hurdles in your loan application and provide you the solutions to approval.

We will guide you through every step, ensuring all documentation is correct, increasing the chances of approval